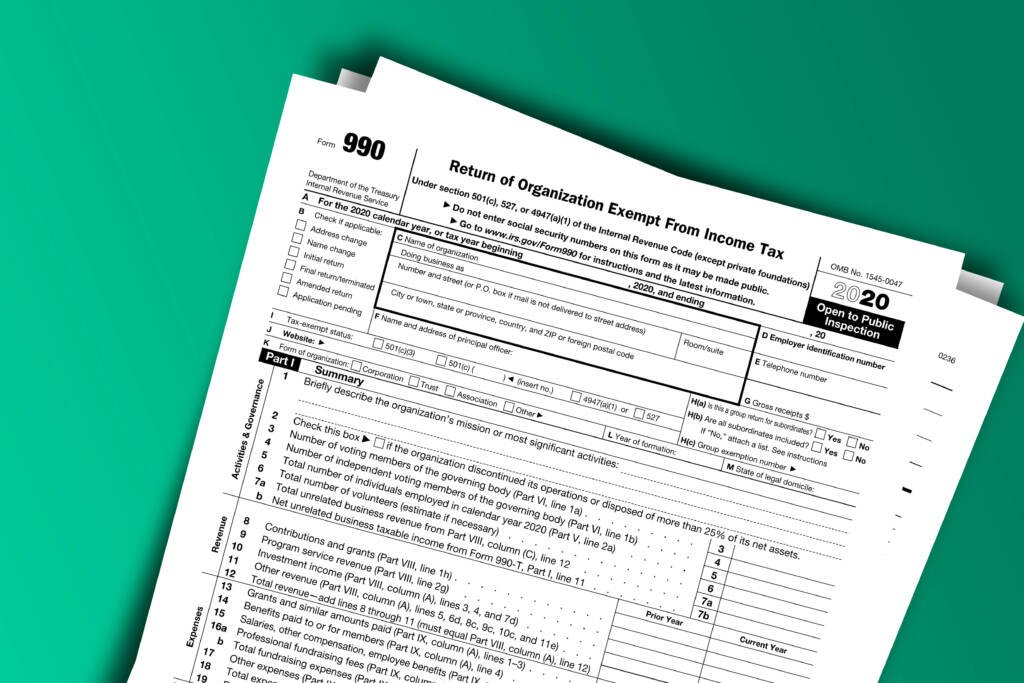

Our Nonprofit Tax Return Preparation service is built on niche specialization, delivering the focused expertise, precision, and nonprofit confidence that organizations need. By dedicating ourselves exclusively to nonprofit tax, we avoid the diluted expertise of larger firms that spread their attention across multiple industries. This singular focus ensures every return is accurate, compliant, and strategically aligned with the unique requirements of the nonprofit sector.

Singular Services | Data Gathering

With this service we gather the tax data from your accounting records based on what best suits your needs and operations. This collection is completed as prescribed by your e-file provider and submitted to them timely. The IRS trusts and relies on Certified Public Accountants for understanding and accuracy and so can you.

Form 990-EZ data gathering, or e-file only

We meet and collaborate with you to collect data in the method prescribed by your e-file provider. Vetted while it is collected, we then submit on your behalf and are available to any subsequent information requests or verification.

Form 990 data gathering, or e-file only

Similar to our Form 990-EZ data gathering service, data is collected using the methodology your e-file provider requires. We remain available to you until your Form 990 is accepted by the IRS to respond to any subsequent inquiries.

Dual Services | Data Gathering & E-Filing

Gathering your data is the heaviest lift in filing you return. Let us take that weight of off your shoulders. Using this service, there is no need to transfer your data to, or to use more than one service provider to file your return timely. After we have gathered your data, we then e-file with the IRS. We usually fulfill your compliance requirements within two weeks of starting services.

E-file your federal Form 990-N

We will meet or otherwise coordinate with you to obtain supporting documentation to meet this filing requirement, and then submit to the IRS on your behalf. If state Forms are needed, these are separately billed.

Data gather & e-file your federal Form 990-EZ

Two services in one, all of our services begin with meeting with you to understand your operations and needs. Together we decide on a timeline and needed accounting access and to collect your data in a meaningful manner, for seamless data entry into your federal Form 990-EZ. Data is vetted for accuracy per the Internal Revenue Code, ensuring that all entered data is final as pulled, allowing us to timely file your return.

Data gather & e-file your federal Form 990

This service is not only submission but includes data gathering. Similar to our Form 990-EZ services, your service is tailored to your specific needs. Timelines are created and adhered to, and the process meets all IRS standards in reporting. As collected, data is simultaneously vetted for completeness and accuracy.

Form 1023 Submission & Consulting

Are you starting a new nonprofit entity in the US? We’ve helped clients gather and submit their 1023 applications and receive their determination letters in as little as eight weeks. It is the perfect service to book with us to compliment your future annual compliance needs.

Internal Federal Compliance Review

If your Form 990 is already completed, our experts will examine the completeness and accuracy of its reporting for cohesiveness and adherence to IRS requirements to identify and correct any potential concerns prior to finalizing and submitting to the IRS.